November 2025 Market Update

November 2025 Market Update

By Brian Woolard, Broker

The latest realMLS housing data for November 2025 offers a clear snapshot of a market that’s shifting—but not stalling. Whether you’re a buyer, seller, or investor, understanding these trends can help you make smarter decisions in the months ahead.

Sales Activity Slows, but Prices Hold Steady

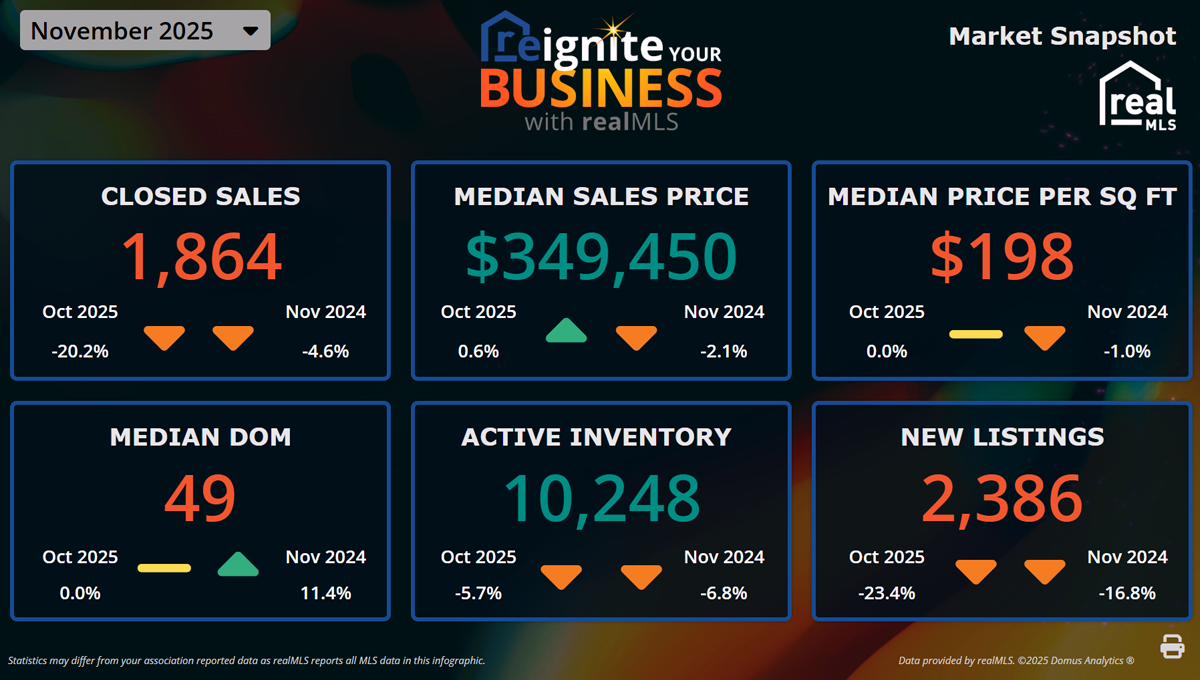

November recorded 1,864 closed sales, a notable 20.2% drop from October and a 4.6% decrease year-over-year. This seasonal slowdown is common as the holidays approach, but the year-over-year decline highlights a more cautious buyer pool navigating higher costs, tighter credit, and economic uncertainty.

Despite fewer transactions, home values are proving resilient:

Median sales price: $349,450

-

+0.6% from October

-

-2.1% compared to November 2024

Price per square foot: $198

-

Flat month-over-month

-

-1.0% year-over-year

These figures suggest that while buyers are more selective, sellers who price accurately are still achieving solid results.

Days on Market Reflect a Calmer Pace

Homes spent a median of 49 days on market, unchanged from October but 11.4% longer than last year. This is another signal of a cooling—but not collapsing—market. Buyers have a bit more breathing room, and sellers should expect more measured showing traffic compared to the frenzy of previous years.

Inventory Tightens Again

Active inventory dipped to 10,248 homes, down:

-

5.7% month-over-month

-

6.8% year-over-year

Fewer choices for buyers often help stabilize prices, especially when combined with steady demand. At the same time, new listings fell sharply:

2,386 new listings in November

-

23.4% below October

-

16.8% below last year

This drop is significant. It reflects both seasonal patterns and a “wait-and-see” mindset among would-be sellers—many of whom are holding onto lower mortgage rates from prior years.

What This Means for You

For Buyers:

More time to shop and negotiate, but fewer homes to choose from. Well-priced homes still move quickly, so stay pre-approved and ready.

For Sellers:

Demand hasn’t disappeared; it’s just more measured. Pricing strategy and property condition matter more now than ever. Well-prepared homes are still commanding strong offers.

For Investors:

Softening prices and longer DOM can create new opportunities. Lower competition, paired with tightening inventory, may set the stage for more favorable buying conditions heading into 2026.

If you’d like to talk about how these trends affect your goals, or you want a personalized market analysis for your property, I’m always here to help.

BW

Thanks.